Solana’s active validator count has dropped from about 2,500 to under 900 since early 2023, roughly a 64% decline.

Even so, people working in the ecosystem say the network is stronger today. They note that many of the validators that left were slow or caused problems for the chain’s performance.

With those operators gone, congestion has eased, and the system now runs more smoothly.

Tomas Eminger, Chief Infrastructure Officer at RockawayX, noted that a large portion of existing validators were using outdated hardware, unable to support Solana’s expanding activity.

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in November2025

What Does the ‘Three-for-One’ Validator Adjustment Mean for Solana?

Developers say a smaller validator set does not mean weaker security. They argue the network is healthier and more efficient, noting that fewer nodes can still uphold strong performance.

This shift is tied to changing economics. The Solana Foundation has been cutting back on the amount of SOL it delegates to validators to keep operations sustainable.

The subsidy program first helped validators cover the high costs of synchronization and transaction processing. But the Foundation revised it in April.

Under the new structure, three subsidized validators are removed for every new one added. The goal is to move away from artificial support and build a network that can stand on its own.

The cleanup has also pushed out bad actors. Dillon Liang, co-founder of Blueprint Finance, said many of the validators that left were involved in “sandwich” attacks, where bots front-run trades to squeeze extra profit from users.

Their exit has lowered the risk of manipulation and improved overall stability across Solana’s infrastructure.

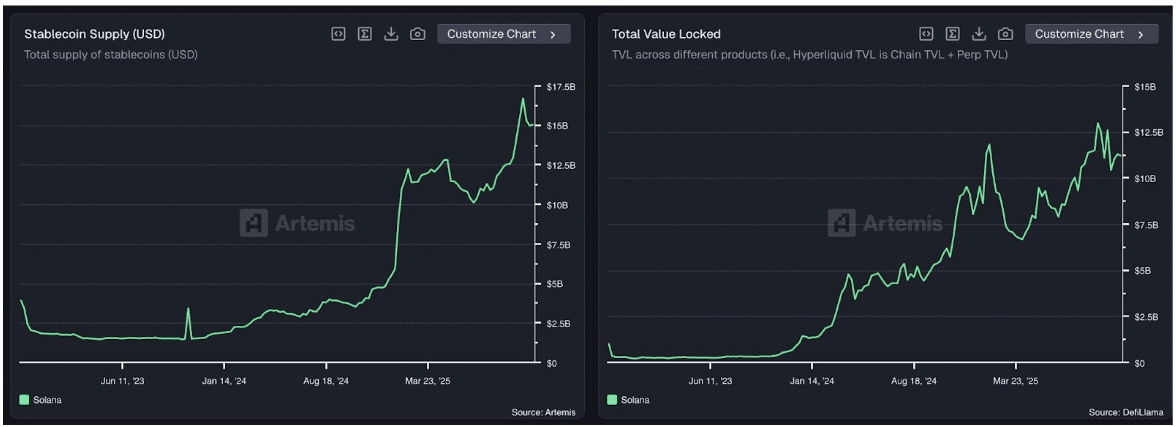

Solana’s total value locked and stablecoin balances keep climbing, signaling steady liquidity growth across the network.

Developers say the pickup comes as more DeFi teams, both old and new, prepare to release products.

Institutional payment integrations are also moving ahead, adding another layer of activity.

The network has made changes that may help support this trend. A revised asset-listing process, new perpetual markets, and active launchpads have broadened the toolkit for builders.

Taken together, these steps suggest a supportive setup for Solana-based DeFi in the months ahead.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

Solana Price Prediction: Is SOL Entering a Consolidation Phase After Breaking the Triangle Pattern?

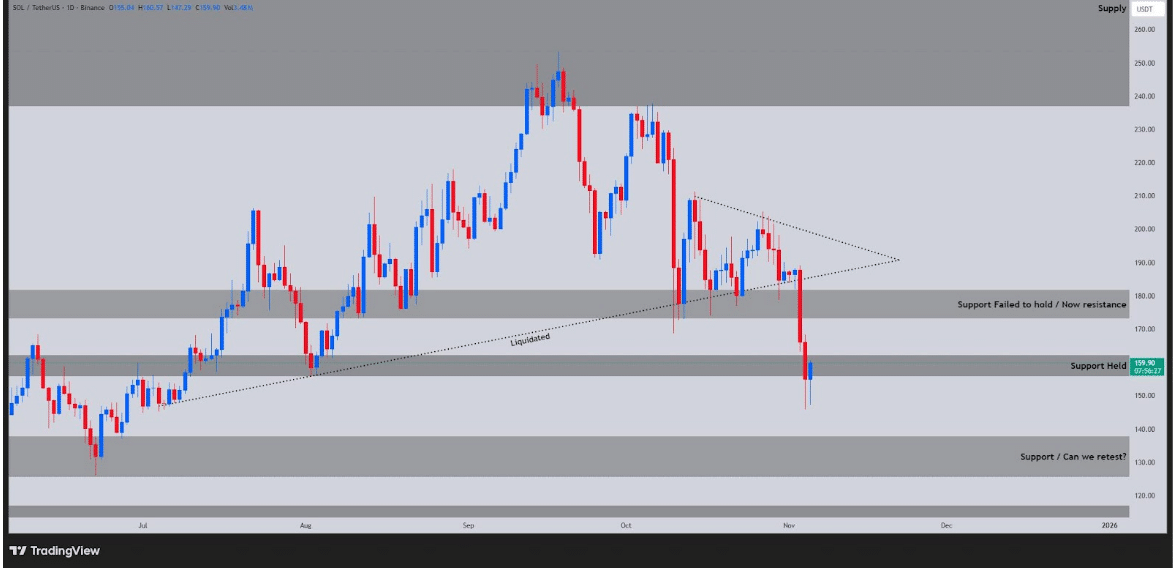

Solana (SOL) is trying to hold near $160 after a sharp drop from a multi-month consolidation range, based on the chart shared by the analyst.

The token slipped out of a tightening triangle and lost the mid-range support at $175–$180. That area has now turned into resistance.

The breakdown pushed price lower in a fast move, with candles showing strong selling and liquidations along an old ascending trendline.

SOL is now bouncing from a familiar demand zone at $155–$165, where buyers stepped in earlier. This area is acting as short-term support, shown by repeated wicks defending the level.

Even so, the setup still leans bearish as long as SOL stays below the old support area. If the price cannot reclaim the $175–$180 zone, pressure on the downside may continue.

The next clear support sits in the $135–$145 range. If selling pressure stays firm, the price could move toward that zone for a retest.

Bears still have control after the clean break below the triangle and repeated rejection at major supply areas.

To shift momentum, SOL would need to reclaim $180. A move above that level could open the way toward the $200 resistance.

DISCOVER: 20+ Next Crypto to Explode in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The post Solana Price Prediction: Can Solana Stay Secure as Active Validators Shrink Below 900? appeared first on 99Bitcoins.