As we are watching Bitcoin’s price action closely, a massive options expiration event approaches this Friday, and about $23 billion in Bitcoin options contracts are set to expire, creating a catalyst for flash volatility. This event follows a period of already sharp market movement, where Bitcoin’s price jumped to just below $90,000 last week before today’s dump cancelled its own run.

Here, I, Akiyama Felix, originating from the Crypto Class of 2018, will break down the concept of option expiration and explain why it matters for us in crypto.

Options Expiration and Why It Affects Bitcoin and the Market

Think of a Bitcoin option as a contract that gives us the right, but not the obligation, to buy or sell Bitcoin at a specific price on a future date. It’s like putting a down payment on a car to lock in today’s price, but you can walk away by just losing the deposit.

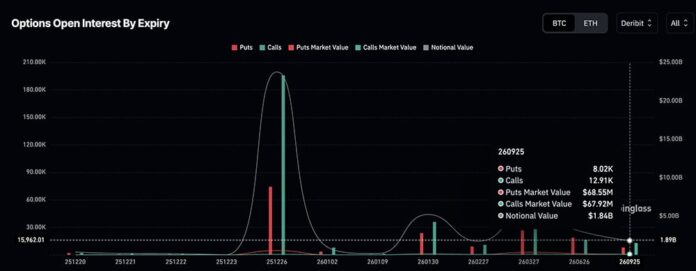

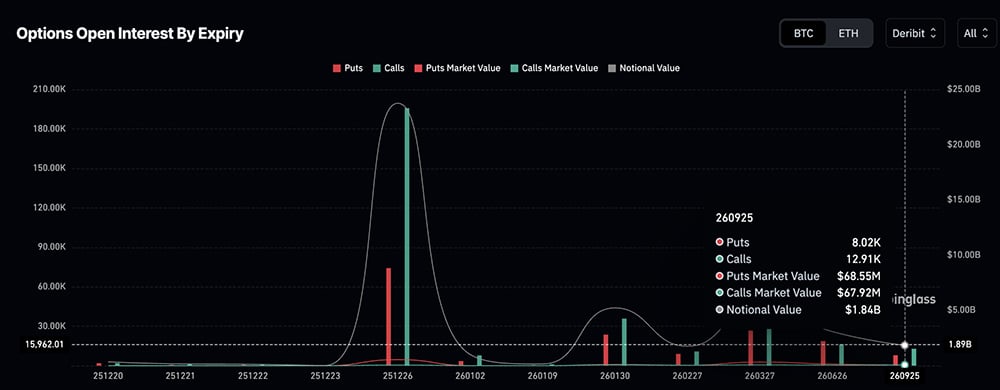

Tomorrow, $23 billion worth of these options will expire on Deribit, the largest crypto options exchange. According to a report from Bloomberg, this figure represents over half of all open contracts on the platform. When they expire, crypto traders will be forced to choose whether to execute their trades, which then will create a wave of buying and selling that can rock the market.

(source – Coinglass)

While $23B is the headline, the real story is the ‘Max Pain’ point on Bitcoin price, which is currently sitting near $85,000.

Having watched this metric all week, I’ve seen market makers actively hedging to keep the price pinned below $88,000, suggesting that any breakout attempt before 8:00 AM UTC Friday will face heavy resistance. As we know, Big portfolio traders may attempt to push the spot price toward this level to benefit their own positions.

(source – BTC USD, TradingView)

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

How Could This Expiry Impact Your Bitcoin?

However, large expiries don’t always guarantee chaos, but they absolutely increase the odds of it. The hours leading up to and immediately following the expiration are known for unpredictable price action and sudden Bitcoin liquidations. For us, though, this means we should prepare for a bumpy ride.

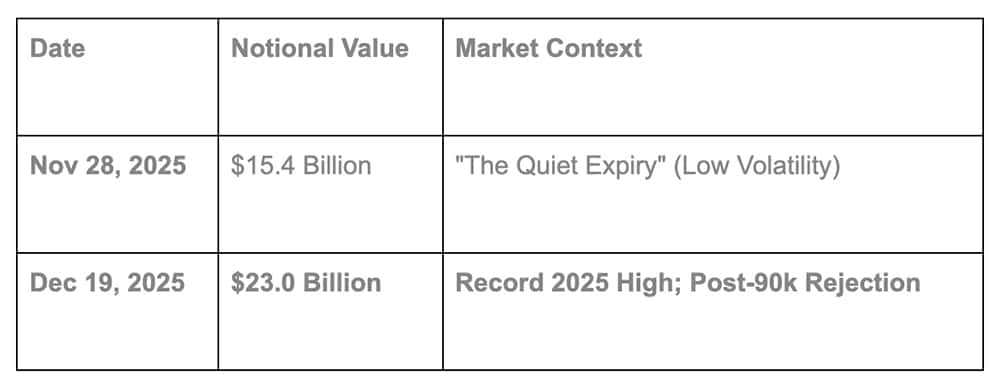

The growth of these events highlights how much the market has matured. This year, Deribit has repeatedly hit record open interest, with a $15 billion expiry becoming almost routine. The expansion of regulated products from institutions like the CME with its crypto derivatives also shows that professional traders are deeply involved.

However, not every expiry results in a crash. A similarly large $15.4 billion expiry in late November produced very little volatility. Some analysts believe this was due to better hedging strategies from institutional players, a sign that the market is getting better at absorbing these shocks.

This expiry is particularly heavy because it’s effectively the ‘last stand’ for the 2025 Santa Rally. Traders are either rolling into 2026 or capitulating, which is why we saw that $148M liquidation spike on Wednesday.”

For now, we wait and be bullish because the expirations are more of a vehicle instead of a cause of volatility.

DISCOVER: 10+ Next Coin to 100X In 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The post Bitcoin Braces for Impact as $23 Billion Options Bomb Set to Expire appeared first on 99Bitcoins.