As a trader, knowing the best crypto staking platforms saves you from wasting time, locking funds in low yield pools, or trusting platforms that don’t deliver on rewards or security. With so many options promising high returns, it’s easy to feel overwhelmed or make a costly mistake. The right choice can help you grow passive income steadily, while the wrong one can eat into your profits or limit flexibility when the market shifts.

In this review, we will explain the best staking platforms to use in 2025, how they compare on rewards, ease of use, and safety, and which ones make sense depending on your goals, experience level, and preferred assets. We’ll break everything down clearly so you can stake with confidence and maximize returns without guesswork. Keep reading

Best Crypto Platforms for Staking Rewards in 2025

| Platform | Cryptocurrencies Supported | Maximum Reward Rate | Fees | Exchange Type |

| Binance | BTC, ETH, BNB, ADA, etc. | Up to 10% | 0%-3.75% | Centralized |

| Crypto.com | BTC, ETH, CRO, DOT, etc. | Up to 19% | 0%-4% | Centralized |

| ByBit | BTC, ETH, USDT, XRP, etc. | Up to 10% | 0%-2% | Centralized |

| Coinbase | BTC, ETH, SOL, ADA, etc. | Up to 13% | 0% – 3.99% | Centralized |

| KuCoin | BTC, ETH, KCS, DOT, etc. | Up to 13% | 0.1% | Centralized |

| Kraken | BTC, ETH, DOT, ADA, etc. | Up to 21% | 0-0.1% | Centralized |

| Lido | ETH | Up to 8% | 10% of staking rewards | Decentralized |

| Rocket Pool | ETH | Up to 3.27% | 15% of staking rewards | Decentralized |

| Nexo | BTC, ETH, USDT, etc. | Up to 15% | No fees for staking | Centralized |

| Stakely | ETH, ADA, DOT, etc. | Up to 34% | Validator fees vary (low) | Decentralized |

| Gemini | BTC, ETH, GUSD, etc. | Up to 8% | No fees for staking | Centralized |

| Margex | BTC, ETH, USDT, etc. | Up to 11% | No infom | Centralized |

| Aave | ETH, USDT, DAI, etc. | Up to 9% | 0.09% | Decentralized |

| Bake | BTC, ETH, DFI, etc. | Up to 20% | 0.1% – 0.2% | Centralized |

| Babylon Labs | ETH, BTC, etc. | Up to 10% | No info | Decentralized |

15 Best Crypto Staking Platforms Reviewed By Our Experts

When it comes to earning passive income through cryptocurrency, choosing the right platform is crucial. With numerous options available, finding the best crypto platforms for staking rewards can be overwhelming. To make your decision easier, we’ve reviewed the top 15 platforms, highlighting their staking options, key features, and what sets them apart.

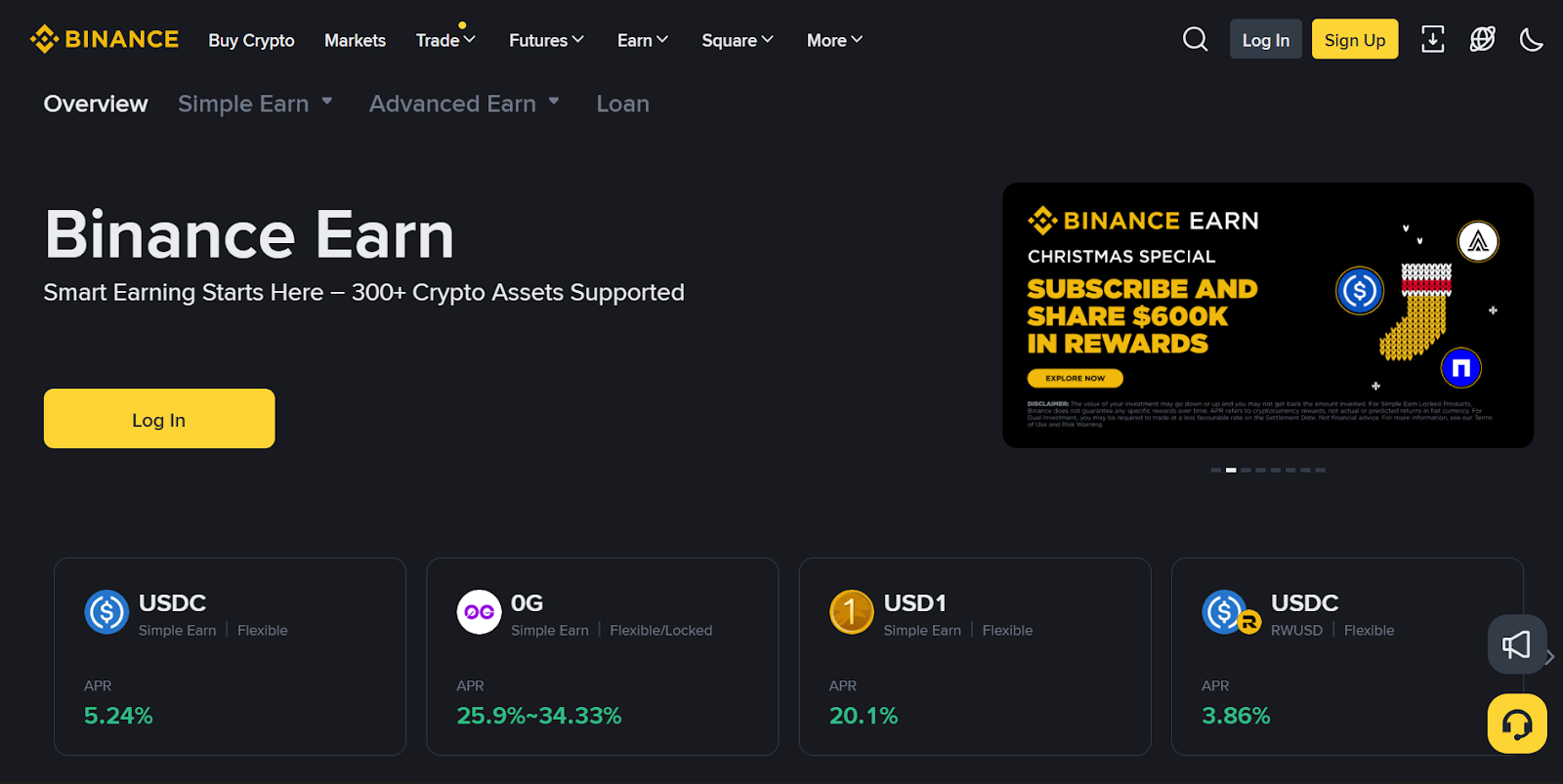

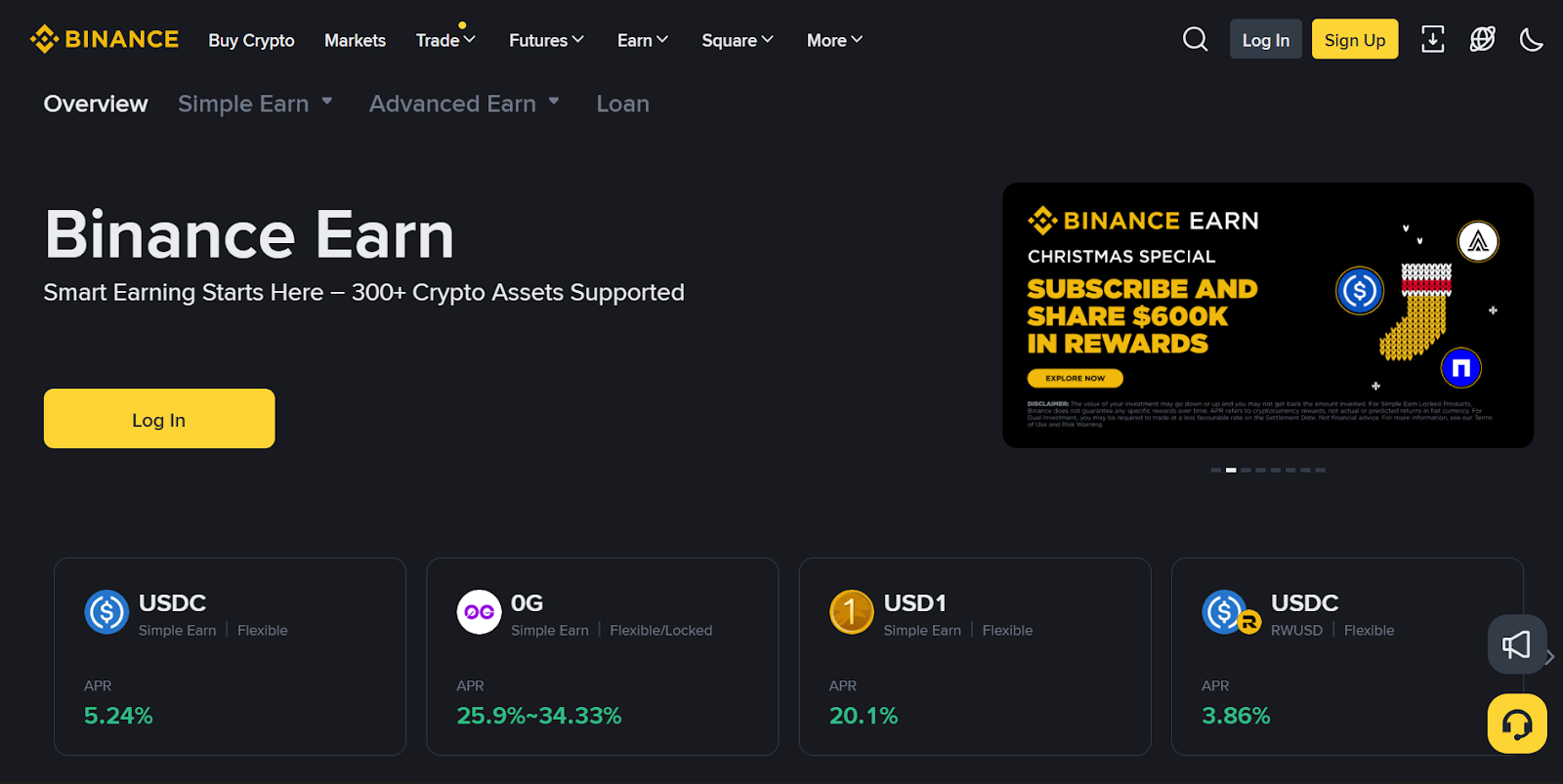

1. Binance

Binance remains one of the most widely used options for staking come 2025, especially if you want everything in one place. You can trade, stake, and manage your portfolio without transferring funds between platforms, saving time and reducing complexity. Supporting over 60 proof-of-stake coins, Binance provides both flexibility and control, making it a top choice for maximizing rewards. Its competitive APY rates and robust security measures ensure a reliable and rewarding staking experience. Whether you’re new to staking or a seasoned investor, Binance’s user-friendly interface makes it easy to get started.

Staking Options

Binance offers both flexible and locked staking options. Flexible staking allows you to withdraw your funds anytime, while locked staking provides higher rewards for committing your assets for a set period. Popular coins like Ethereum (ETH), Binance Coin (BNB), and Solana (SOL) are available for staking.

Key Features

- Transparent reward rates and lockup periods.

- Auto-invest plans for compounding returns.

- Industry-leading security with multiple protection layers.

- A user-friendly interface for easy navigation.

2. Crypto.com

Crypto.com simplifies staking by integrating it into its broader ecosystem, making it easy to manage alongside trading and spending. With support for over 250 cryptocurrencies, it’s a versatile platform for earning passive income. The platform’s focus on predictability and clear terms makes it ideal if you prefer stability over chasing high-risk returns. Its intuitive app design ensures that managing rewards, spending, and trading feels effortless, even for beginners.

Staking Options

Crypto.com offers flexible and fixed-term staking options. Fixed-term staking provides higher APY rates, while flexible staking allows you to maintain liquidity. CRO token holders enjoy additional benefits, including boosted rewards and exclusive perks.

Key Features

- APY rates up to 19% for select assets.

- Enhanced rewards for CRO token holders.

- Strong security measures to protect your assets.

- Transparent terms and a beginner-friendly interface.

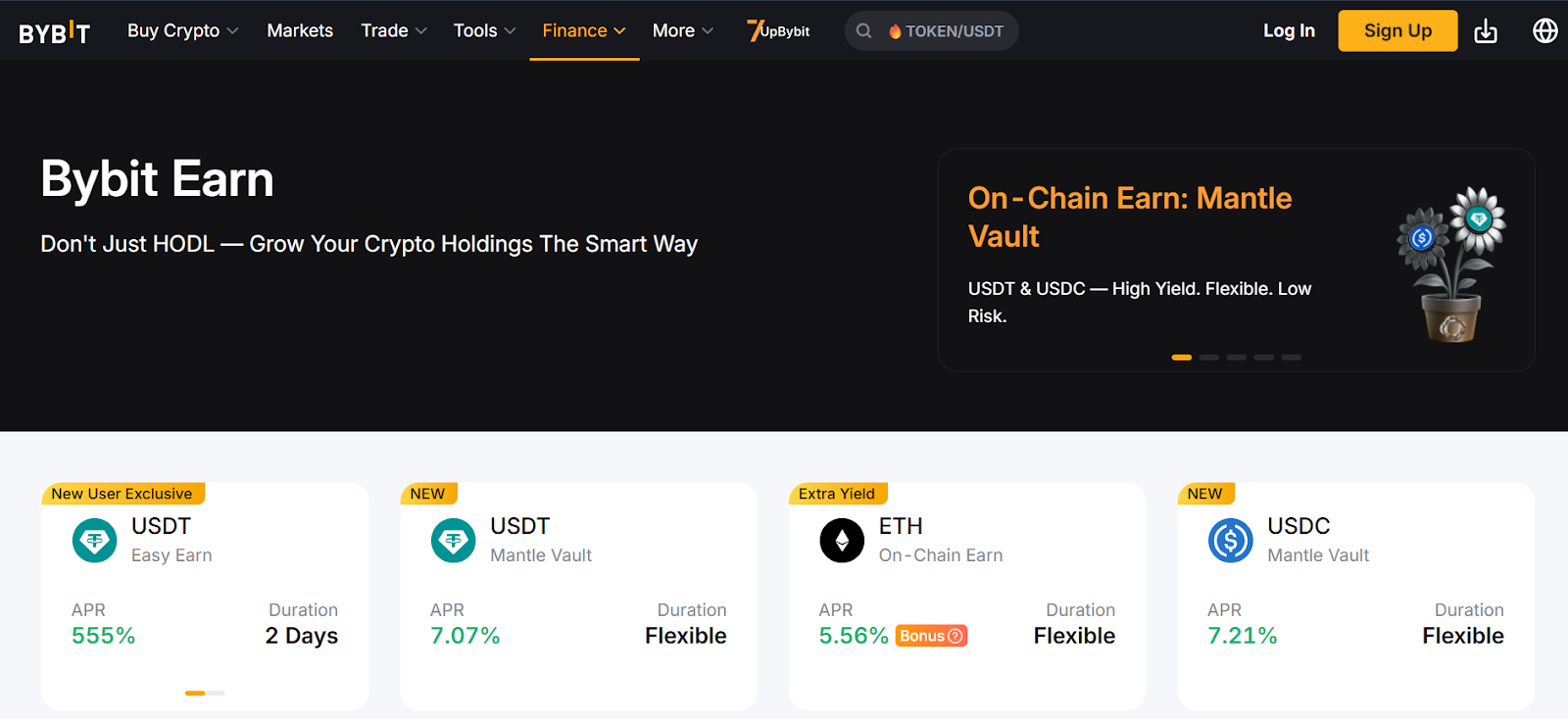

3. ByBit

ByBit is tailored for active traders who want to earn staking rewards without interrupting their trading activities. Supporting over 650 cryptocurrencies, ByBit combines flexibility with high-yield opportunities. Its frequent limited-time promotions with boosted returns make it a dynamic choice for maximizing rewards. ByBit’s focus on speed and flexibility ensures that you can move funds easily and track rewards in real time.

Staking Options

ByBit provides flexible staking products, allowing you to withdraw funds anytime. It also offers promotional staking events with higher APY rates for a limited period. Popular assets like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) are available for staking.

Key Features

- Real-time tracking of staking rewards.

- Seamless integration with trading activities.

- Competitive APY rates on a wide range of assets.

- A focus on speed and flexibility for active investors.

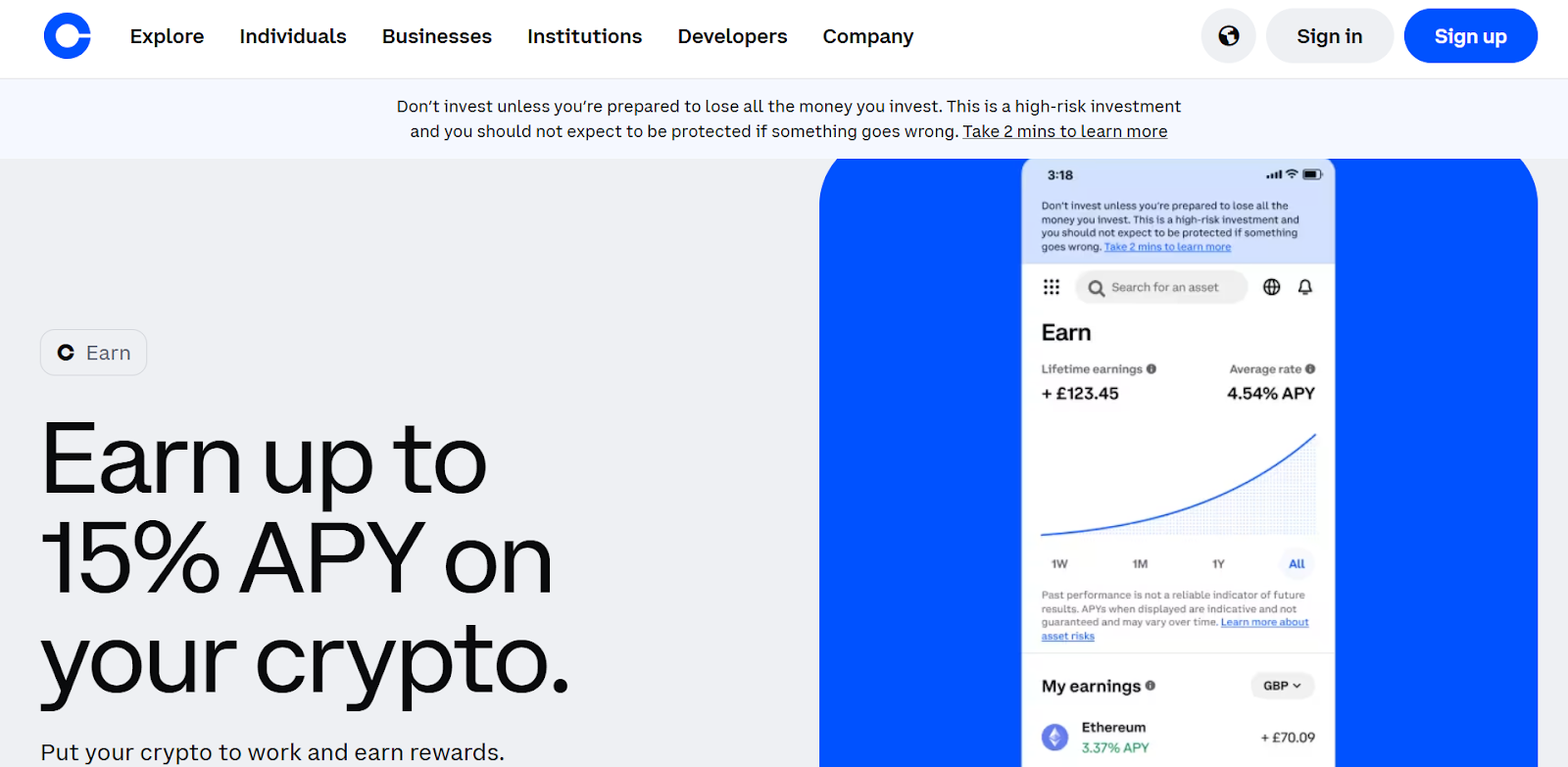

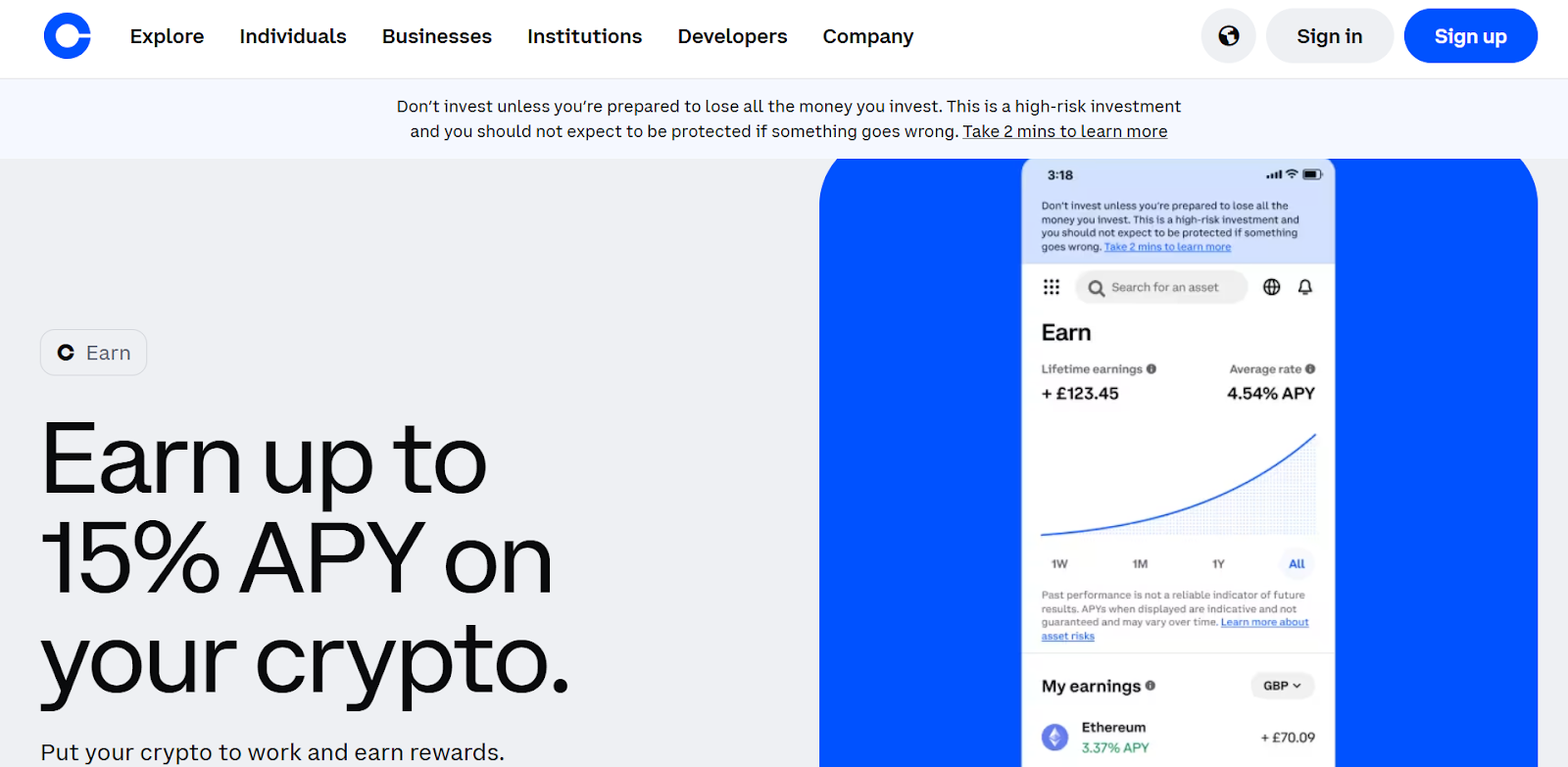

4. Coinbase

Coinbase is a trusted name in the crypto space, known for its transparent and regulated approach to staking. It’s an excellent choice if you value simplicity and security over maximizing yields. With support for six major cryptocurrencies, Coinbase ensures a straightforward staking experience. Its reputation as a secure and regulated exchange adds an extra layer of trust, making it a favorite among long-term holders.

Staking Options

Coinbase offers staking for Ethereum (ETH), Solana (SOL), and other popular assets. Most staking options come with no lockup periods, providing flexibility for long-term holders. Rewards are calculated transparently, and payouts are consistent.

Key Features

- Clear explanations of reward calculations and payout schedules.

- No hidden terms or complex lockups.

- A secure and regulated environment for peace of mind.

- User-friendly interface for beginners and experienced investors alike.

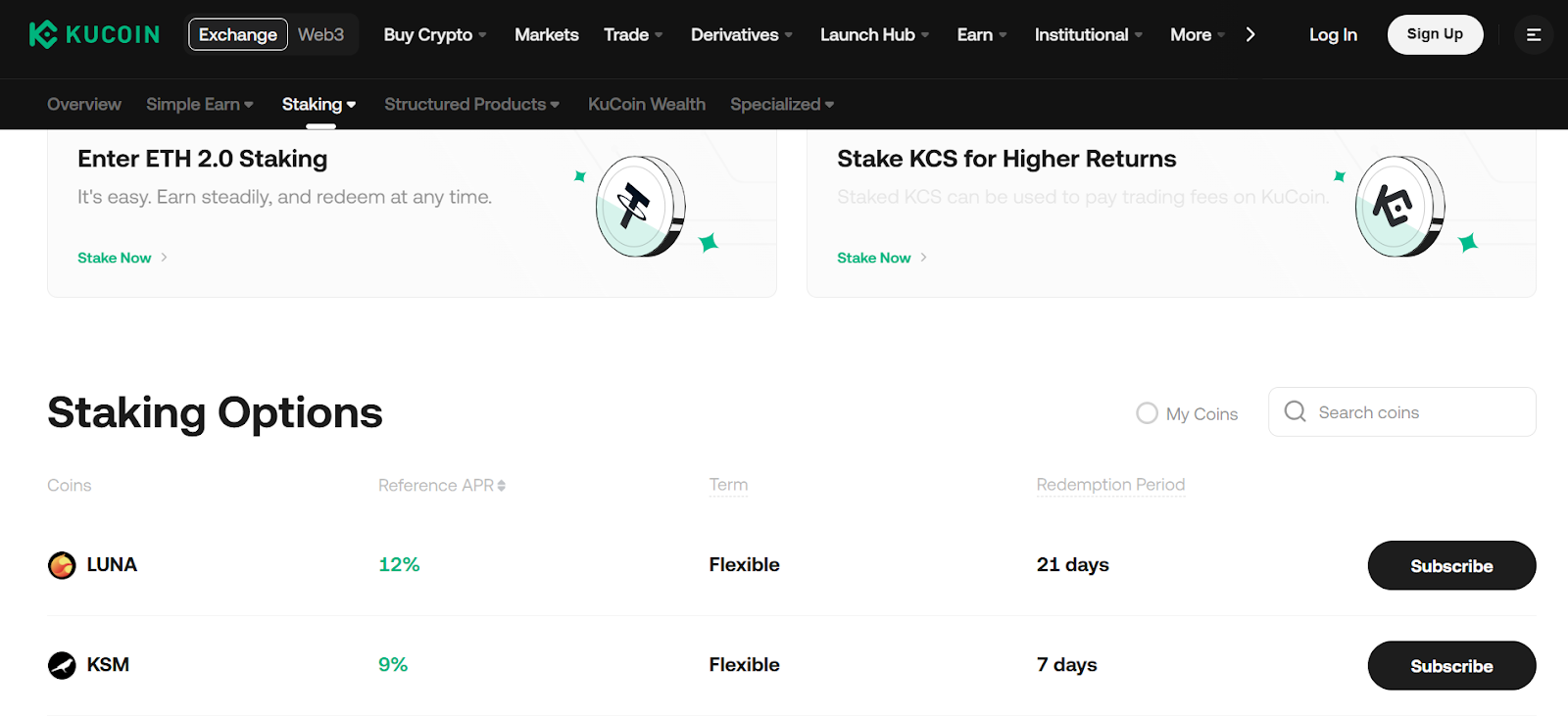

5. KuCoin

KuCoin is a go-to platform for those who enjoy exploring lesser-known coins. With support for over 50 cryptocurrencies, it offers a variety of staking options to suit different investment strategies. KuCoin’s promotional events and high APY rates on emerging assets make it a standout choice. Its strong security measures and global reach ensure a safe and rewarding staking experience.

Staking Options

KuCoin provides both flexible and locked staking options. Locked staking offers higher rewards, while flexible staking ensures liquidity. The platform also supports staking for newer and less common coins, giving you access to unique opportunities.

Key Features

- Access to a wide range of staking assets.

- High APY rates on emerging cryptocurrencies.

- KuCoin Earn for additional earning opportunities.

- Strong security measures to protect your investments.

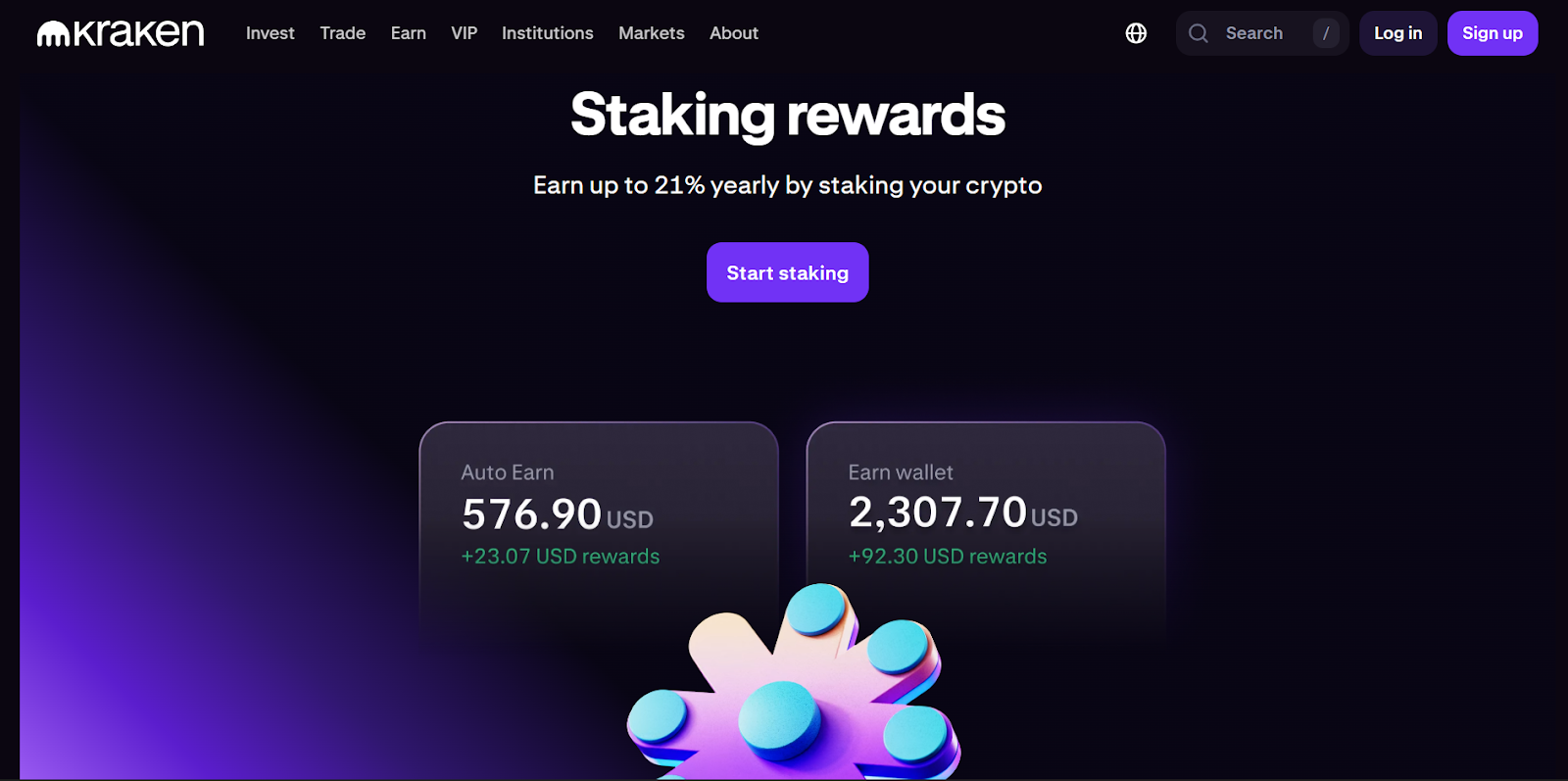

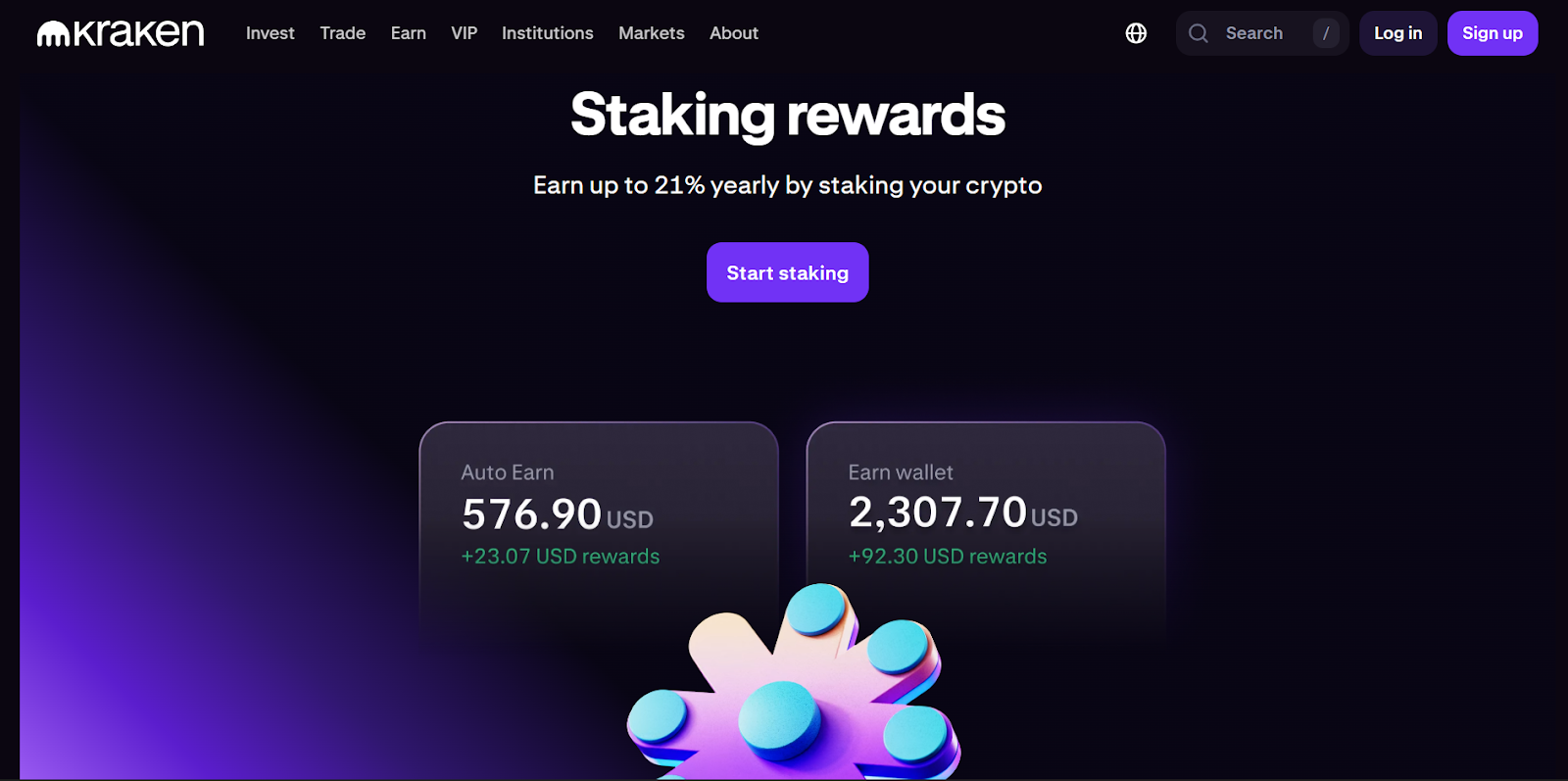

6. Kraken

Kraken focuses on stability and consistency, offering staking for over 200 cryptocurrencies with APY rates of up to 21%. The platform’s clear reward schedules and carefully selected assets make it a reliable choice if you value predictability. Kraken’s low fees and transparent reward schedules add to its appeal, making it a trusted name in the crypto space.

Staking Options

Kraken provides both flexible and bonded staking options. Bonded staking offers higher rewards but requires a longer commitment period. Supported assets include Ethereum (ETH), Polkadot (DOT), and Cardano (ADA).

Key Features

- APY rates of up to 21% on select assets.

- Low fees ranging from 0% to 0.1%.

- A focus on security and transparency.

- Detailed analytics to optimize your staking strategy.

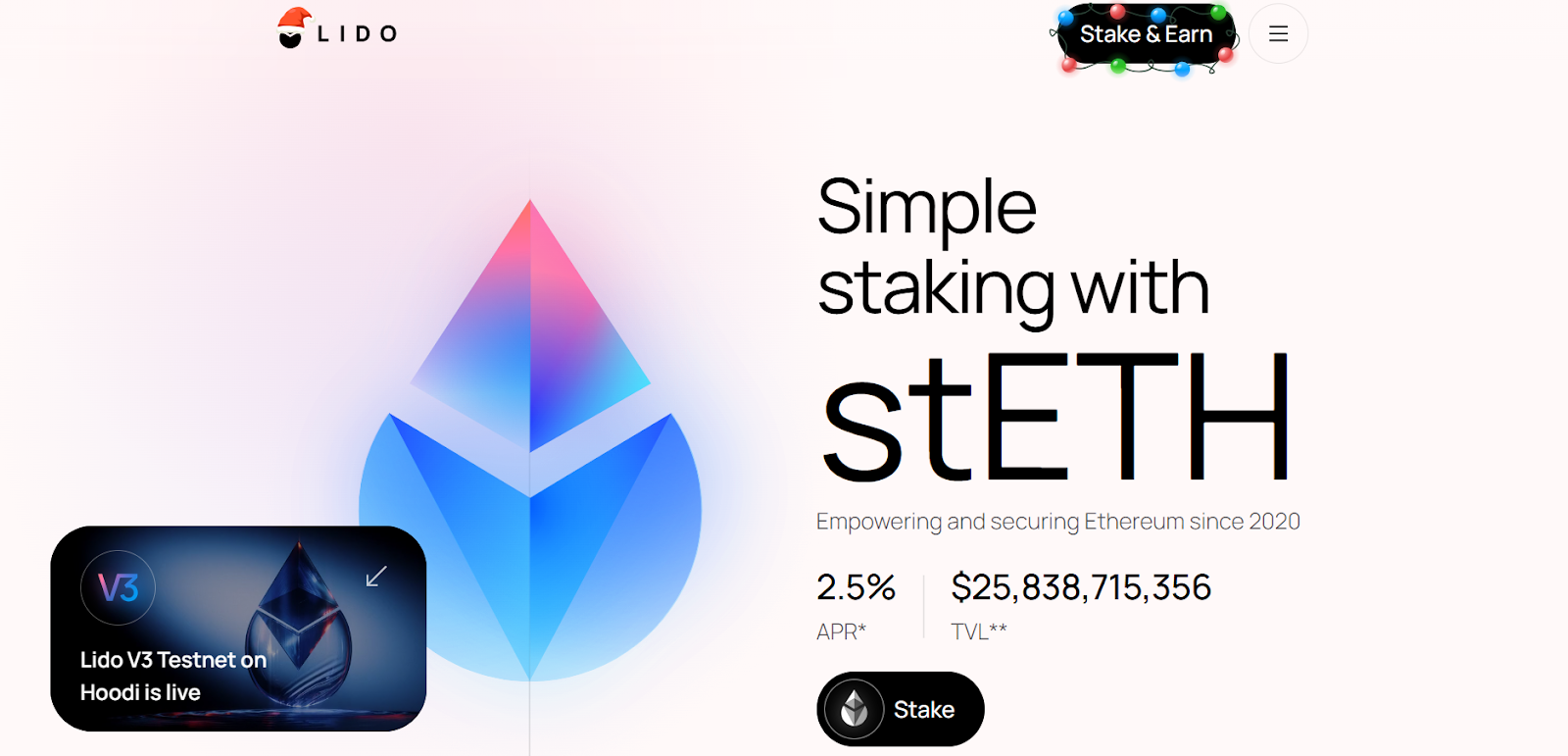

7. Lido

Lido is a decentralized platform specializing in liquid staking, particularly for Ethereum. It allows you to stake ETH while keeping your assets usable across decentralized applications. This unique approach makes Lido a favorite among DeFi enthusiasts. Its non-custodial nature ensures that you retain control of your assets, while its focus on security and transparency has earned it a strong reputation.

Staking Options

Lido supports liquid staking for Ethereum, where you receive stETH tokens representing your staked ETH. These tokens can be used in DeFi protocols for additional earning opportunities.

Key Features

- Non-custodial staking for enhanced security.

- APY rates of up to 8% for Ethereum staking.

- Flexibility to use staked assets in DeFi applications.

- A strong reputation for transparency and innovation.

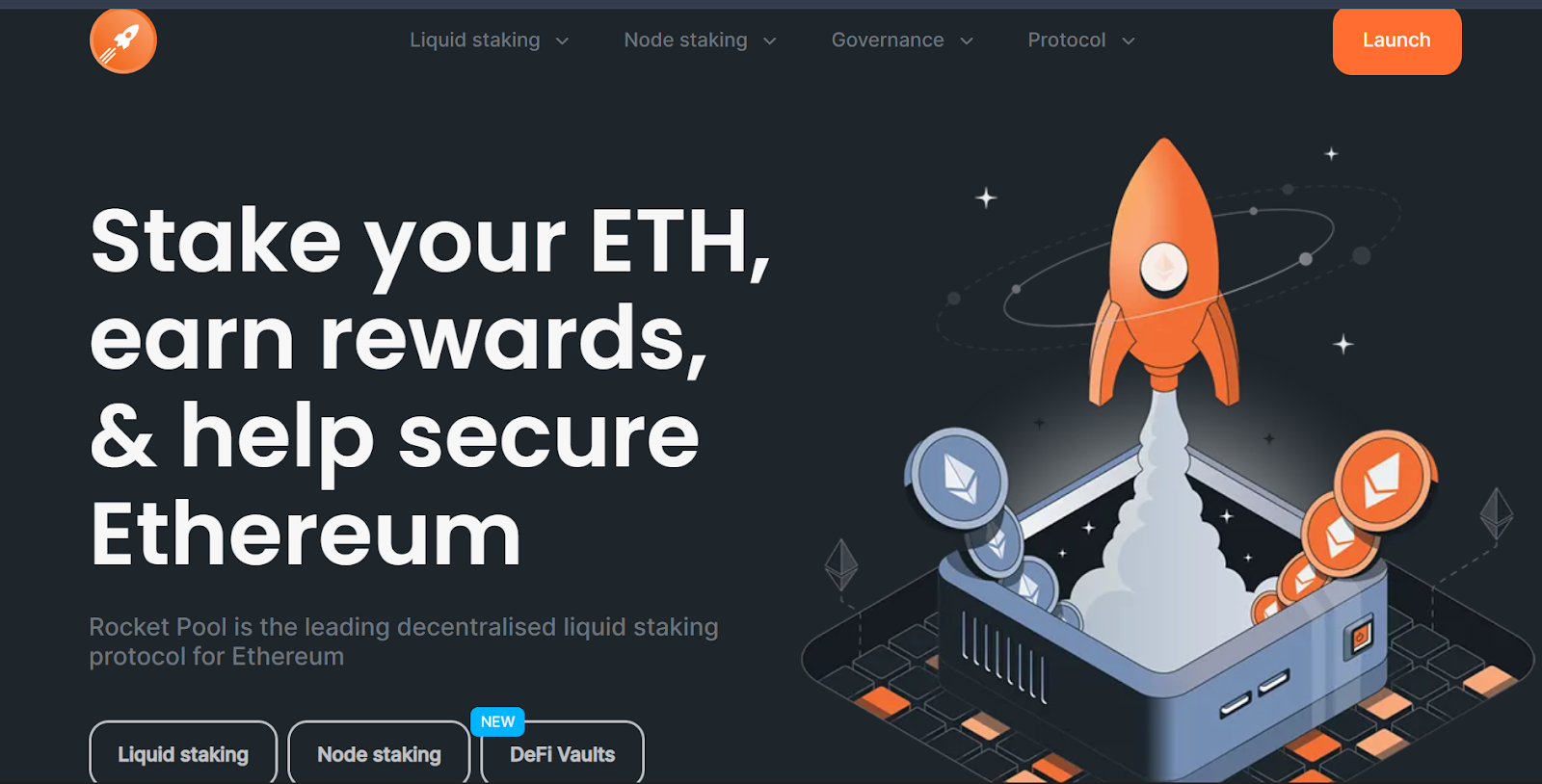

8. Rocket Pool

Rocket Pool is a community-driven platform that emphasizes decentralization and network health. It’s an excellent choice if you want to participate in Ethereum staking without running your own infrastructure. Rocket Pool’s focus on decentralization and security makes it a standout choice among the best DeFi staking platforms.

Staking Options

Rocket Pool offers liquid staking and node operation options. You can stake ETH and receive rETH tokens, which can be used across DeFi platforms. Node operators earn additional incentives, adding value to the staking process.

Key Features

- Decentralized staking with community involvement.

- Additional incentives for node operators.

- APY rates of up to 3.27% for Ethereum staking.

- A focus on security and decentralization.

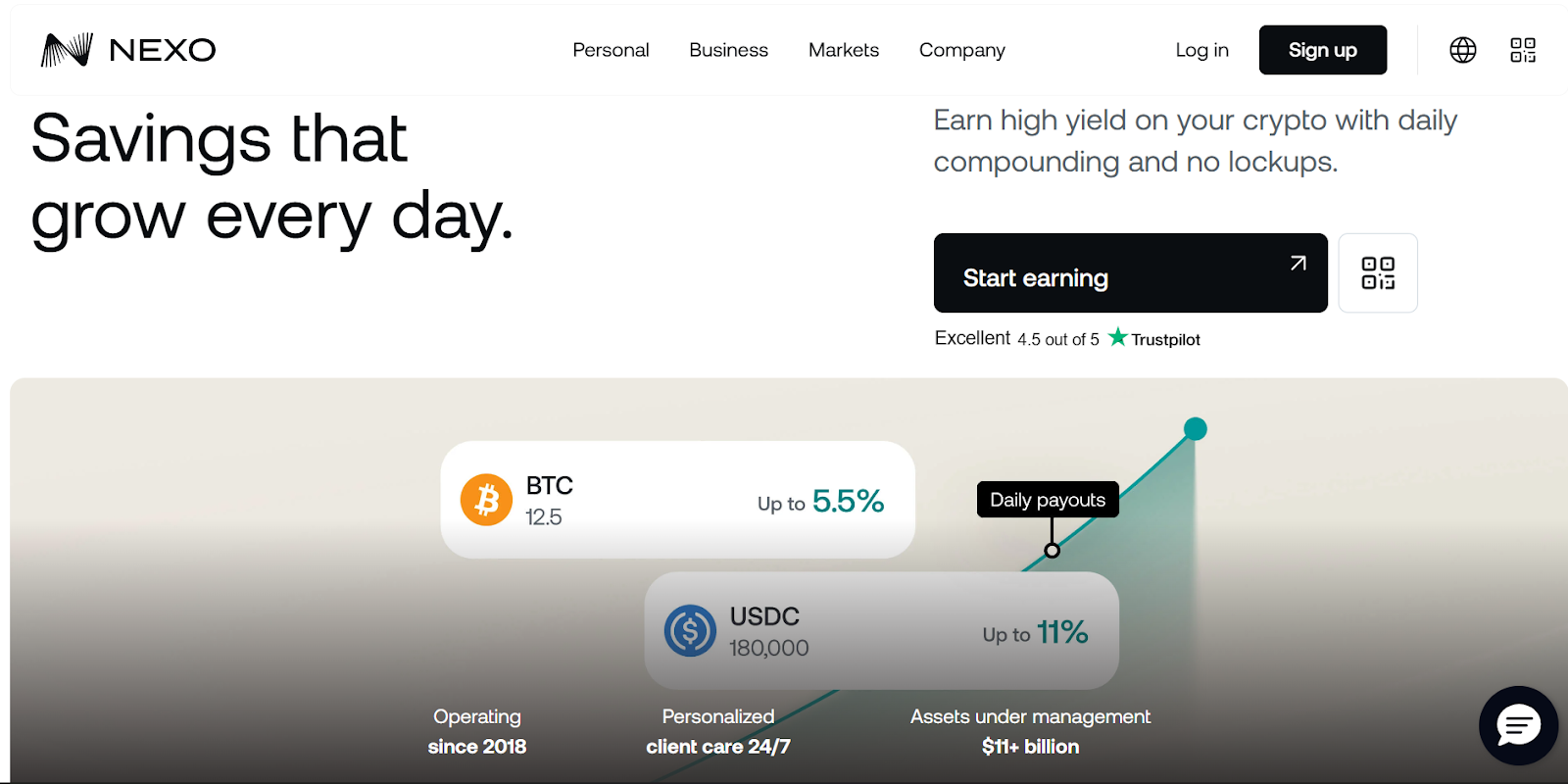

9. Nexo

Nexo combines staking with broader earning features, making it a convenient option for passive income. With frequent payouts and clearly defined reward tiers, Nexo simplifies the staking process. Its user-friendly interface and strong security measures ensure a seamless staking experience.

Staking Options

Nexo supports staking for over 20 cryptocurrencies, including Ethereum (ETH) and Bitcoin (BTC). Rewards are based on loyalty levels, with higher tiers offering better returns.

Key Features

- APY rates of up to 15% on select assets.

- Daily payouts for consistent earnings.

- A user-friendly interface for effortless management.

- Strong security measures to protect your funds.

10. Stakely

Stakely is a validator service that stands out among the best crypto exchange platforms for its focus on reliability and transparency. It’s an excellent choice if you want to participate directly in network validation without the hassle of technical setup. Supporting over 30 blockchains, Stakely provides a secure and user-friendly staking experience. Its emphasis on infrastructure-focused participation makes it a trusted name in the staking community.

Staking Options

Stakely supports staking for a wide range of blockchains, including Ethereum (ETH), Polkadot (DOT), and Cosmos (ATOM). Rewards vary by chain, with some offering the highest APY crypto staking rates, reaching up to 34%.

Key Features

- Non-custodial staking for enhanced control.

- Staking insurance to protect against slashing events.

- A focus on reliability and transparency.

- Support for over 30 blockchains, making it one of the best platforms for crypto staking.

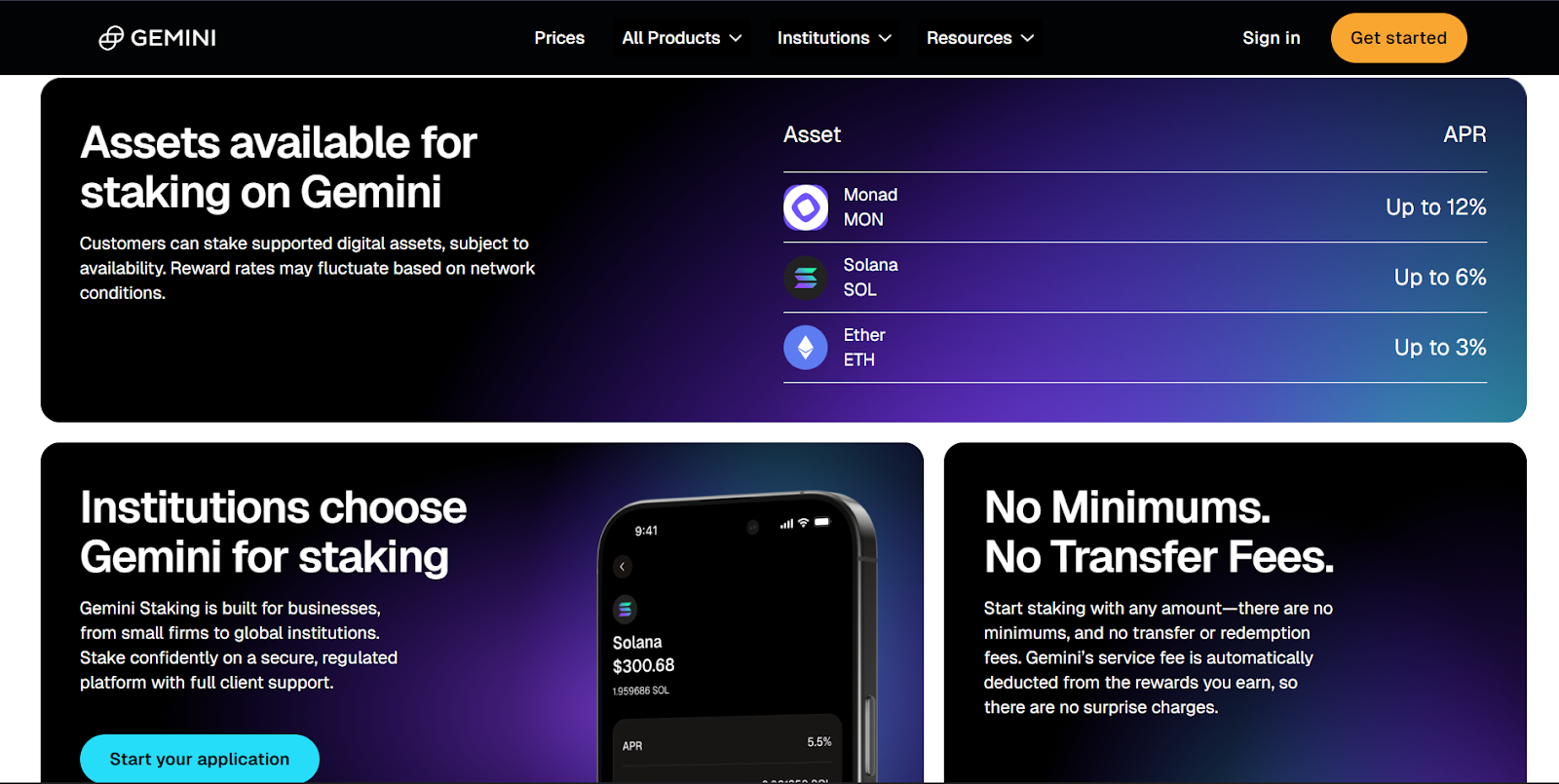

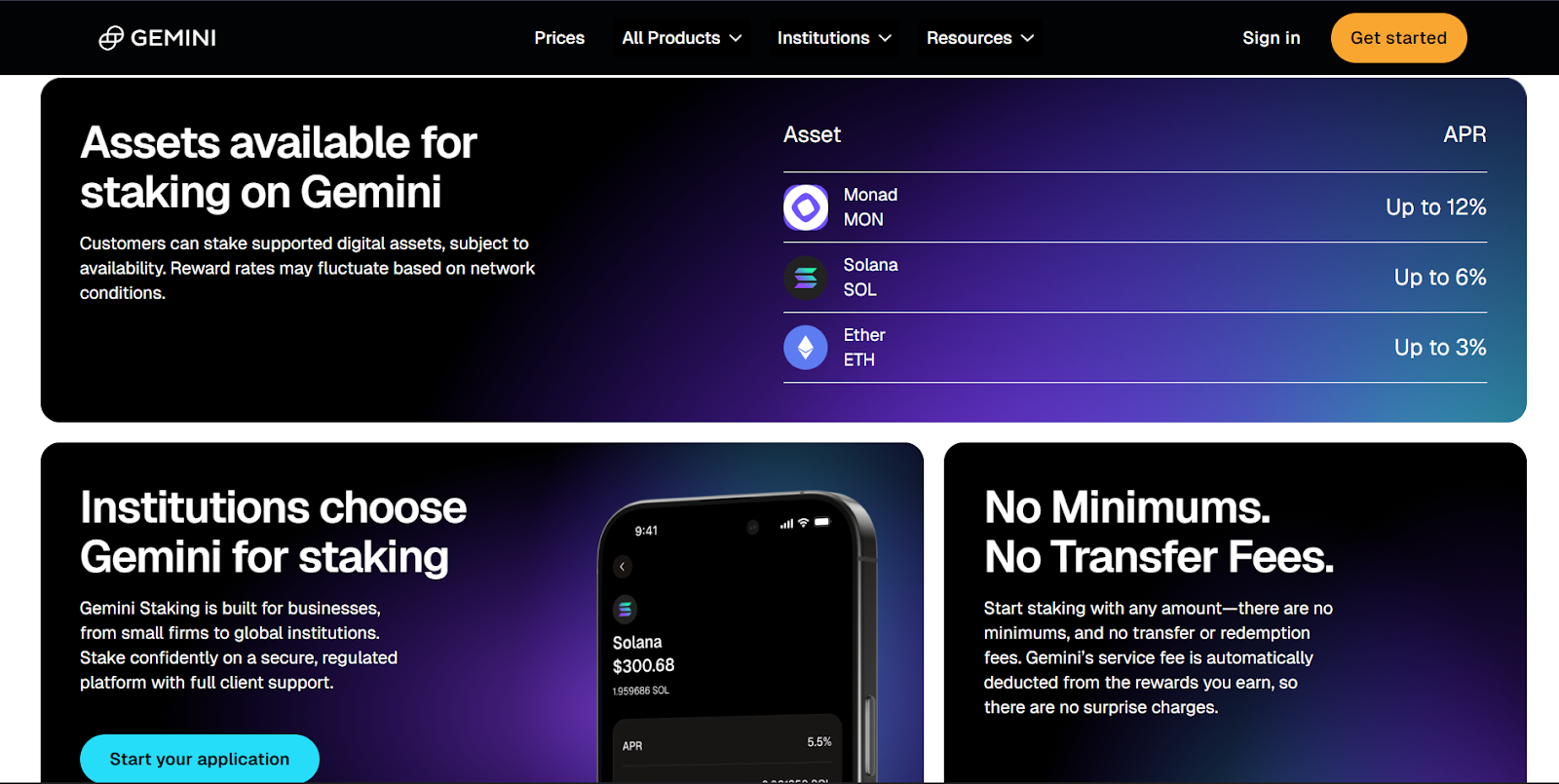

11. Gemini

Gemini is a regulated platform that prioritizes security and compliance, making it a top choice for conservative investors. While its staking options are limited, Gemini’s focus on user protection and transparency ensures a straightforward and secure experience. If you’re looking for a platform that balances simplicity with trust, Gemini earns its place among the best staking providers.

Staking Options

Gemini supports staking for Ethereum (ETH), Solana (SOL), and a few other cryptocurrencies. With APY rates of up to 8%, it’s a reliable option for long-term strategies.

Key Features

- A secure and regulated environment.

- Transparent reward calculations and payout schedules.

- User-friendly interface for a straightforward experience.

- A strong focus on compliance, making it one of the best crypto platforms for staking rewards.

12. Margex

Margex is a versatile platform that integrates staking-style earning tools alongside trading features. It’s a great option if you want to earn passive rewards without leaving an active trading environment. Margex’s simplicity and focus on convenience make it a relevant choice among the best crypto staking platforms.

Staking Options

Margex supports staking for over 55 cryptocurrencies, including Bitcoin (BTC) and Ethereum (ETH). With APY rates of up to 11%, it offers competitive rewards for traders who value flexibility.

Key Features

- Seamless integration with trading activities.

- Competitive APY rates on select assets.

- A straightforward and user-friendly interface.

- A focus on convenience for active traders, making it one of the best platforms for crypto staking.

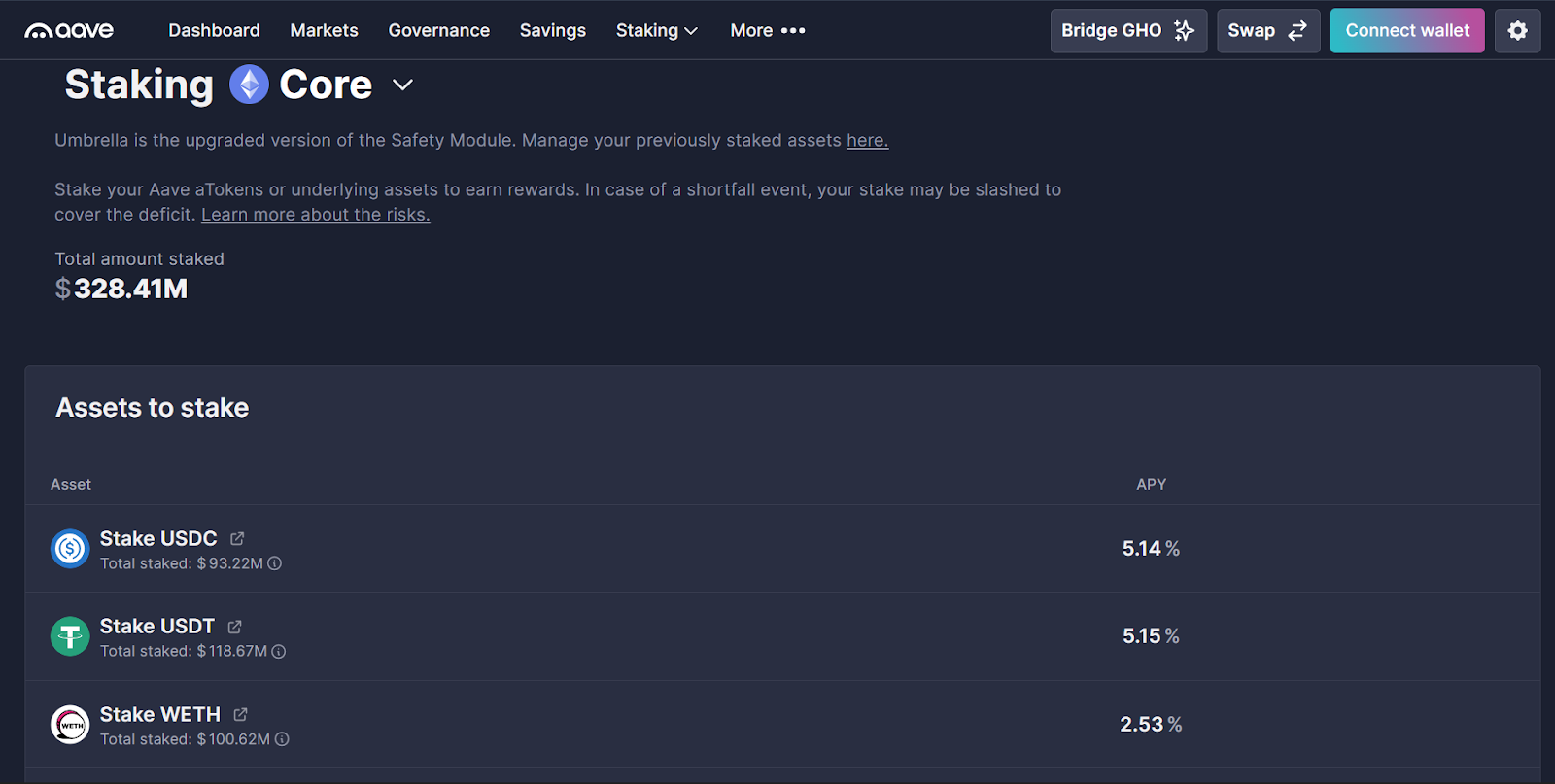

13. Aave

Aave is a decentralized finance (DeFi) protocol that offers staking and lending services, making it one of the best DeFi staking platforms. It’s a strong choice if you’re comfortable with DeFi mechanics and want more control over your investments. Aave’s focus on transparency and innovation ensures a rewarding experience for advanced investors.

Staking Options

Aave supports staking for over 30 cryptocurrencies, including stablecoins and Ethereum (ETH). Rewards depend on market demand and liquidity usage, with APY rates reaching up to 12.22%.

Key Features

- Transparent reward structures and payout schedules.

- A focus on innovation and user empowerment.

- Advanced features for experienced DeFi investors.

- Recognized as one of the best Ethereum staking platforms for its flexibility and control.

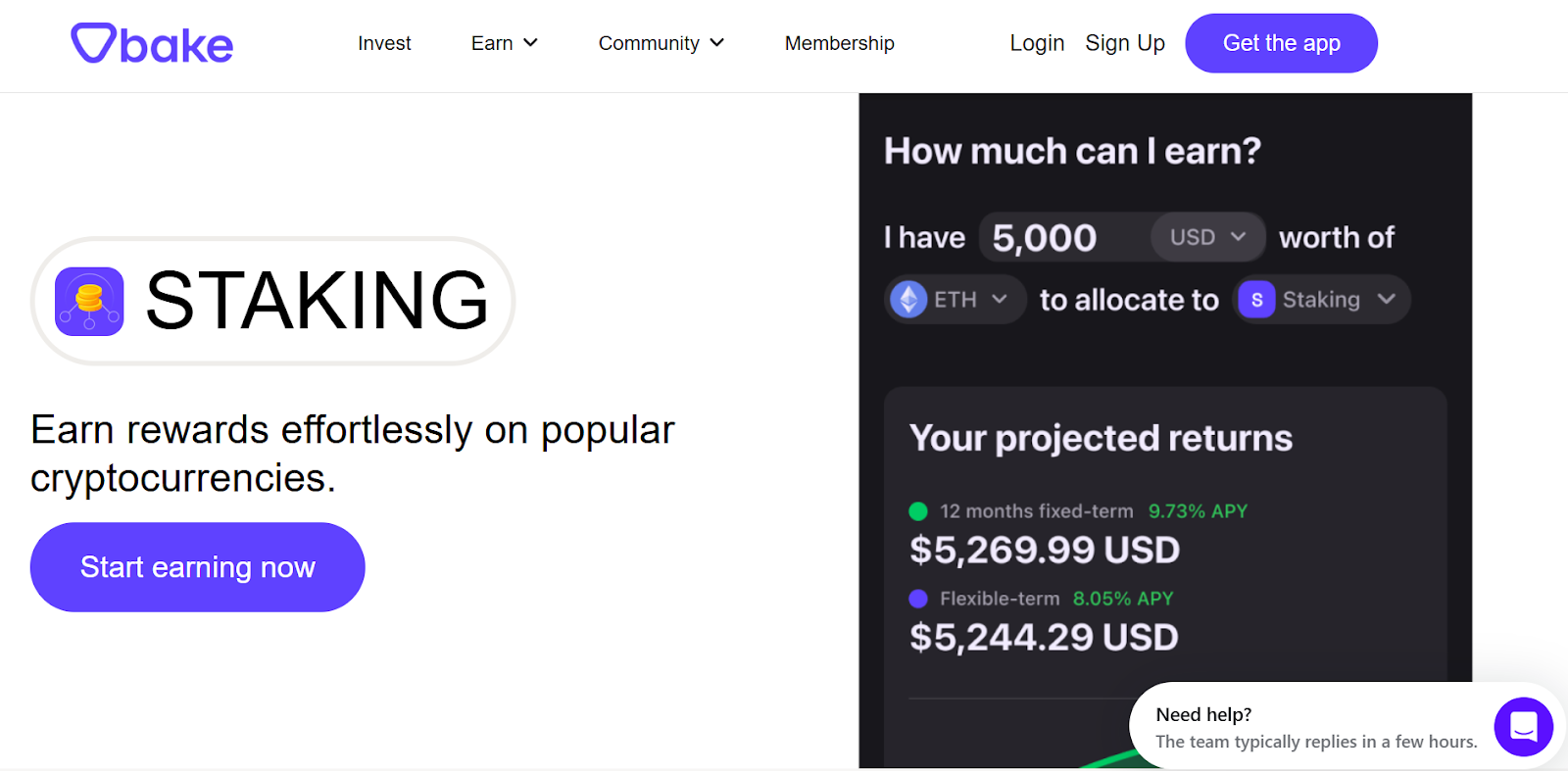

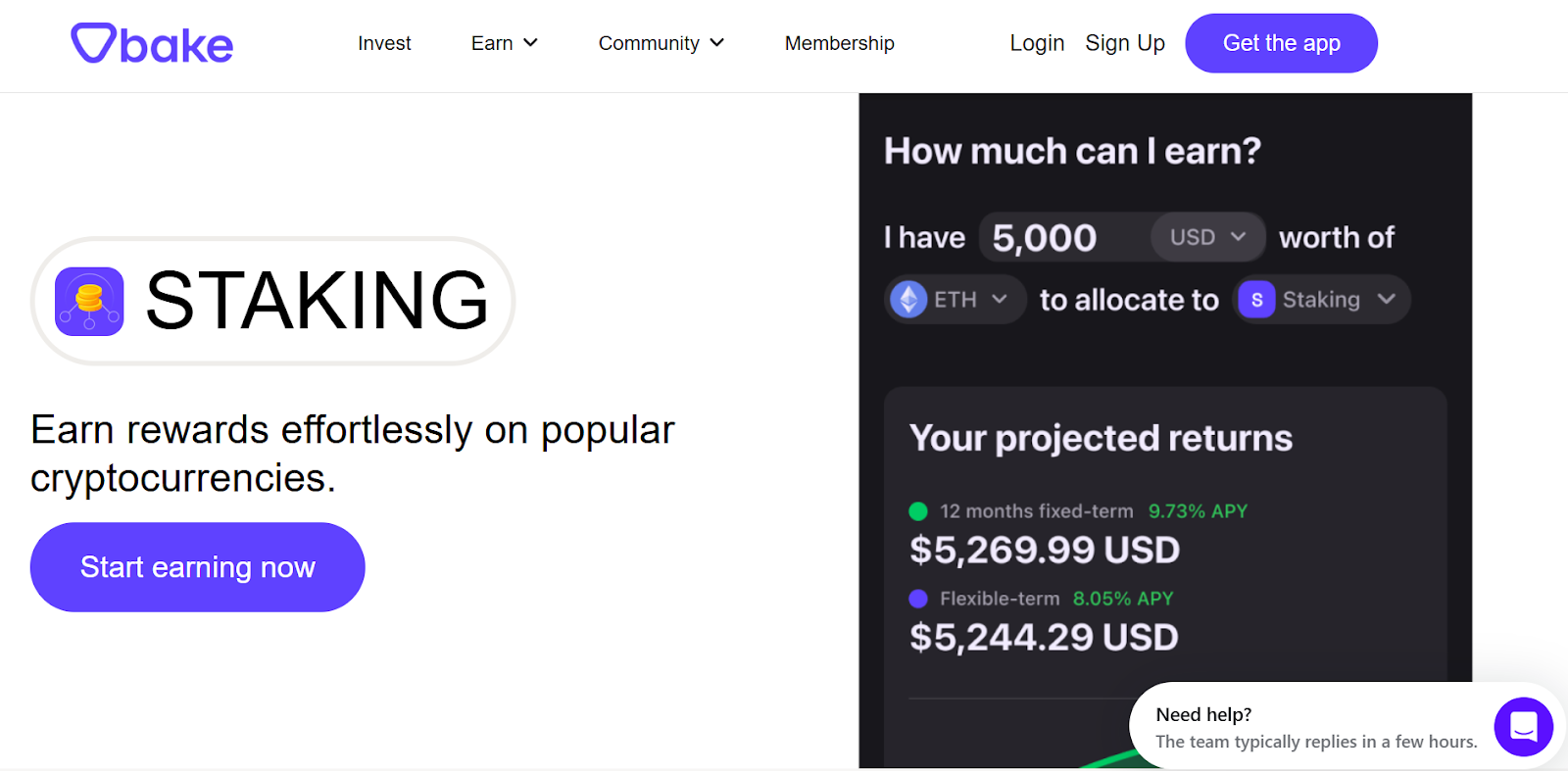

14. Bake

Bake simplifies decentralized earning with a beginner-friendly design and clear explanations. It’s an excellent platform if you’re transitioning from centralized platforms into DeFi. The platform emphasizes transparency by displaying reward calculations and allowing users to verify activity on-chain.

Staking Options

Bake supports staking for several Proof-of-Stake assets, including ETH, MATIC, DFI, and others. Depending on the asset, users may have access to flexible staking options that allow unstaking without long lock-up periods.

Key Features

- Transparent reward calculations and payout schedules.

- Beginner-friendly interface for easy navigation.

- A focus on user education and community engagement.

- Competitive APY rates, making it one of the best staking platforms for new DeFi users.

15. Babylon Labs

Babylon Labs is an emerging platform that focuses on security and innovation in staking infrastructure. While still developing, it shows strong potential for growth and is gaining recognition as one of the best crypto staking platforms to watch in 2025.

Staking Options

Babylon Labs supports staking for over 10 cryptocurrencies, with a focus on emerging networks. Specific APY rates and fees are yet to be disclosed, but the platform emphasizes decentralization and network health.

Key Features

- A focus on decentralization and network health.

- Innovative staking solutions for emerging networks.

- Strong emphasis on security and transparency.

- A promising platform for forward-thinking investors, making it one of the best platforms for crypto staking rewards.

What is a Crypto Staking Platform?

A crypto staking platform is a service or application that allows you to earn rewards by participating in the validation of blockchain transactions. In simpler terms, it’s a way to put your cryptocurrency to work and generate passive income. These platforms support proof-of-stake (PoS) blockchains, where you can lock up your assets, a process known as staking to help secure the network and validate transactions. In return, you earn rewards, often in the form of additional cryptocurrency.

If you’re wondering what is staking crypto, it’s the process of committing your digital assets to a blockchain network for a set period. This helps maintain the network’s operations and security. Staking platforms simplify this process by providing user-friendly interfaces, clear reward structures, and additional features like flexible or locked staking options. Whether you’re a beginner or an experienced investor, these platforms make it easy to participate in staking and earn rewards without needing technical expertise.

How to Choose the Best Staking Platform

Selecting the right staking platform is crucial to maximizing your rewards and ensuring the safety of your assets. With so many options available, it’s important to evaluate platforms based on specific criteria. Here are six key factors to consider when choosing the best staking platform for your needs:

1. Look for the Highest APY Crypto Staking Options

One of the first things to check is the APY or Annual Percentage Yield offered by the platform. The highest APY crypto staking options can significantly boost your earnings, especially if you are staking for the long term. However, be cautious of platforms offering unrealistically high returns, as they may come with hidden risks. Always balance high rewards with platform reliability.

2. Evaluate Security and Reputation

Security should be a top priority when choosing a staking platform. Look for platforms with a strong reputation, robust security measures, and a history of protecting user funds. Features like two-factor authentication, cold storage, and insurance against slashing events can provide an added layer of security.

3. Check for Ethereum Staking Support

If you are interested in staking Ethereum, ensure the platform supports it. Ethereum is one of the most popular assets for staking, and platforms like Lido and Rocket Pool are often recognized as the best Ethereum staking platforms. Additionally, understanding what is Ethereum and its role in decentralized finance can help you make informed decisions about staking this asset.

4. Consider Flexibility and Lockup Periods

Different platforms offer varying levels of flexibility. Some allow you to withdraw your funds anytime through flexible staking, while others require you to lock up your assets for a set period through locked staking. If you need liquidity, opt for platforms with flexible staking options. For higher rewards, locked staking may be a better choice.

5. Assess User Experience and Interface

A user-friendly interface can make a big difference, especially if you are new to staking. Platforms like Crypto.com and Binance are known for their intuitive designs, making it easy to track rewards, manage assets, and navigate the staking process. Choose a platform that simplifies the experience without compromising on features.

6. Compare Fees and Additional Features

Fees can eat into your staking rewards, so it is important to compare the costs across platforms. Some platforms charge minimal fees, while others may have higher costs for certain services. Additionally, look for extra features like auto-compounding, staking insurance, or integration with decentralized finance protocols, which can enhance your staking experience.

Are Crypto Staking Platforms Safe?

Cryptocurrency staking platforms are generally considered safe, especially when you choose well-established and reputable options. These platforms operate on blockchain technology, which ensures transparency and security through decentralized networks. The safety of staking depends on several factors, including the platform’s reputation, the security measures in place, and the specific cryptocurrency being staked. Platforms like Binance and Kraken are often regarded as some of the best platforms for crypto staking due to their robust security protocols and long-standing trust in the crypto community.

When exploring the best DeFi staking platforms, understand the risks associated with decentralized finance. Unlike centralized platforms, DeFi staking involves interacting with smart contracts, which can be vulnerable to bugs or exploits. Staking rewards are typically expressed in APY, your earnings are tied to the token’s value. If the token’s price drops significantly, your rewards may not offset the loss. Comprehending what is a blockchain and how it underpins staking platforms can help you minimize risks.

Benefits of Staking on Crypto Platforms

- Passive income without active trading. Staking allows rewards to build over time without constant buying and selling. Once assets are staked, rewards accumulate automatically, which makes it appealing for long term strategies.

- Helps keep blockchain networks running. By staking, crypto assets are used to validate transactions and support network operations. This helps maintain security and stability while rewards are earned for participation.

- Lower entry barrier compared to mining. Staking does not require expensive equipment or high energy use. Most platforms allow participation with relatively small amounts, making it more accessible.

- Compounding can boost long term returns. Some platforms allow earned rewards to be restaked. Over time, this can increase total holdings faster through compounding.

- Energy efficient participation.Proof of stake networks consume significantly less energy than traditional mining systems, making staking a more sustainable way to earn rewards.

Risks of Staking on Crypto Platforms

- Market price fluctuations. Even when rewards are earned, the fair market value of the staked asset can drop. A price decline may outweigh staking gains, especially during volatile market conditions.

- Funds may be temporarily inaccessible.Many staking programs require lockup or bonding periods. During this time, crypto assets cannot be sold or moved, which limits flexibility.

- Reward inflation impact Some networks issue new tokens as staking rewards. If supply grows faster than demand,overall token value may decrease.

- Platform or validator exposure.Using third party platforms introduces risk related to security, technical issues, or poor management. Fees and service quality can also affect final returns.

- Unstaking delays.Even after staking ends, many networks enforce a waiting period before funds are released. This delay can make it difficult to react quickly to market changes.

Conclusion

Choosing the right staking platform involves evaluating factors like security, flexibility, and reward potential. Each platform caters to different needs, offering features for both beginners and experienced investors. When you assess g your options and understand the associated risks, you can select a platform that aligns with your investment goals. Staking continues to be a valuable method for growing cryptocurrency holdings while supporting

FAQs

The best platform to stake crypto depends on your priorities, such as high rewards, security, or ease of use. Platforms like Binance, Kraken, and Lido are popular choices for their reliability and features.

The duration for locking up funds for staking varies by platform and cryptocurrency. Some platforms offer flexible staking with no lock-up, while others require periods ranging from a few days to several months.

Yes, you can stake crypto in the US. Many platforms, including Coinbase and Kraken, allow US-based users to stake cryptocurrencies, though availability may vary by state and regulation.

Liquid staking allows you to stake your crypto while still maintaining liquidity. You receive tokens representing your staked assets, which can be used in other transactions or DeFi activities.

Yes, staking rewards are typically taxed as income in most jurisdictions, including the US. The specific tax treatment depends on local regulations and how the rewards are classified.

The difference between PoS staking and DeFi staking lies in their purpose and mechanism. PoS staking secures blockchain networks, while DeFi staking involves locking assets in decentralized protocols to earn rewards.

The difference between centralized and non-custodial staking is control. Centralized staking involves platforms managing your assets, while non-custodial staking lets you retain full control of your private keys and funds.