Ripple reportedly reached a $40 billion valuation after a fresh funding round, pushing headlines that XRP is “undervalued.” XRP traded near $2.06 on Jan. 12 as the news circulated, holding its range rather than breaking higher. That gap highlights a bigger theme in crypto right now: strong companies do not always lift the tokens linked to them.

This matters because many retail investors treat Ripple like a public company and XRP like its stock. Crypto does not work that way. Understanding the difference can save you from buying hype instead of fundamentals.

We have seen this story before across altcoins as infrastructure firms grow faster than the tokens that share their name.

DISCOVER: Top Ethereum Meme Coins to Buy in 2026

Why Ripple’s Success Doesn’t Automatically Lift XRP

Ripple is a private company that builds payment and settlement software for banks and institutions. XRP is a public crypto token that trades freely on exchanges. They connect through the XRP Ledger, but they are not the same asset.

Think of Ripple as a payments company and XRP as a fuel token that may or may not be required to run the engine. Ripple can grow revenue, sign banks, and raise money without forcing clients to hold XRP. That separation explains why XRP price can stall even when Ripple looks strong.

This distinction already shows up in the market. XRP still struggles to push past resistance levels, as seen in recent XRP price struggles, despite positive corporate headlines.

What Actually Drives XRP’s Value Over Time

XRP does not produce cash flow like a stock. Its value depends on usage. Specifically, whether people must hold XRP to move value across the XRP Ledger.

One way to think about this is speed versus necessity. XRP can move money fast, but if it only sits in wallets for seconds, price pressure stays limited. For XRP to rise in a lasting way, it must become a required liquidity bridge, not an optional shortcut.

BOOOOOOOOOOOOOOOOM

BlackRock is now using Ripple’s $RLUSD as collateral.

Bullish for $XRP. Who’s ready?

pic.twitter.com/2gdb5j5taT

— Amonyx (@amonyx) January 12, 2026

Ripple’s expansion into stablecoins like RLUSD complicates this picture. Stablecoins boost activity on the XRP Ledger, but they can also replace XRP if institutions prefer price stability. Ripple’s stablecoin push is a core part of its growth strategy.

DISCOVER: Top Ethereum Meme Coins to Buy in 2026

Where the Bull Case and Bear Case Split

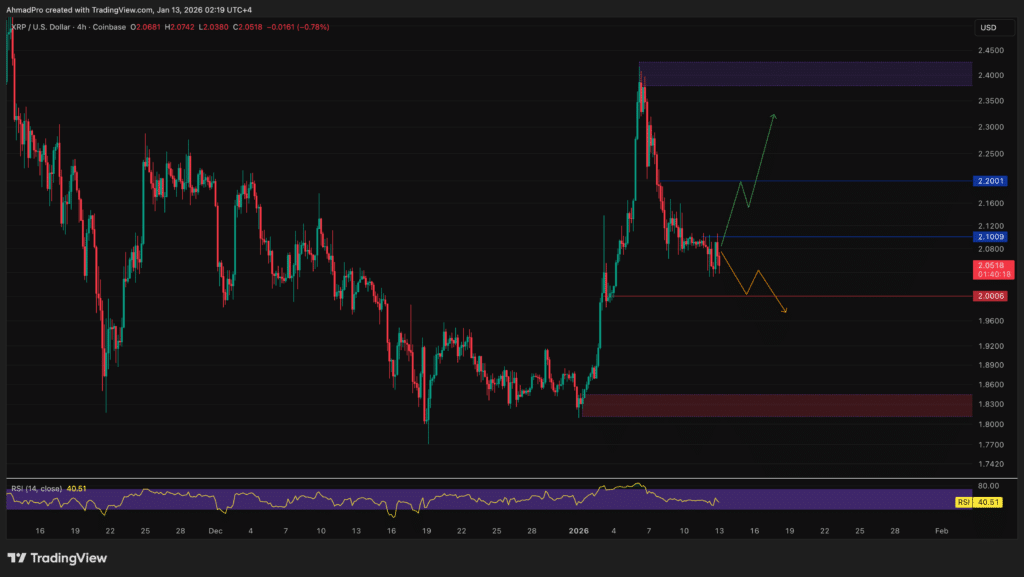

(Source: XRPUSD / TradingView)

The bullish view says Ripple’s acquisitions and institutional rails will force XRP into the center of global payments. If banks must hold XRP to settle at scale, demand rises, and price follows.

The opposing view is simpler. Institutions may use the XRP Ledger without touching XRP at all. They can settle in stablecoins or tokenized dollars instead. In that case, the network grows while the token remains speculative.

This tension already shows up in price action. XRP jumped above $3 after legal clarity in 2025, but momentum faded once excitement cooled

A Practical Checklist for XRP Holders

If you own XRP, track behavior, not headlines. Watch whether payment volumes actually require XRP, not just the XRPL. Monitor how much liquidity flows through XRP pairs versus stablecoins.

Also, separate Ripple news from XRP trades. A Ripple funding round helps the company, not automatically your wallet. That difference explains why even positive stories like Ripple’s UK license win did not spark a breakout.

XRP remains a bet on design, not branding. If Ripple proves XRP is unavoidable for liquidity, price pressure builds. If not, patience matters more than hype.

DISCOVER: Top Solana Meme Coins to Buy in 2026

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis

The post Ripple’s $40B Valuation Isn’t a Free Pass for XRP Price appeared first on 99Bitcoins.