It is understandable now that traders are cautious. The Bitcoin USD price is not trending and is all over the place. There it appears to be no refuge.

At press time, the Bitcoin USD price is under pressure and yet to break above the $90,000 resistance. If anything, given the current state of price action, the odds of the digital gold rallying are lower than those of a price slump.

This shows how the BTC USD price has been printing in the last few trading days. Since November 21, BTC USDT has been in a range, moving sideways with caps at around $95,000 on the upper end and $84,000 on the lower end. As it is, the Bitcoin USD price is around the mid-point, giving sellers of October an upper hand.

With crypto price action choppy and some of the best cryptos to buy facing a gloomy picture, what’s next? Will gold continue defying gravity and extend gains to fresh all-time highs this week?

Why is Bitcoin USD Price Down Today?

What’s visible fits into a broader pattern: After a disappointing Q4 2025, when usually crypto prices rip higher, investors appear to be sensing danger and moving to safety. The USD is the currency of choice.

This outflow to safety only makes crypto, including the Bitcoin USD, fragile. In the morning, during the Asian session, the Bitcoin price crashed, falling to as low as $86,000, briefly extending losses of January 25. The good news is that Bitcoin bulls flew in, slowing down sellers, and pushing prices to around last week’s range.

How Bitcoin performs this week largely depends on politics and how the US proceeds with its relationship with the EU on Greenland. Although a common ground was reached last week, investors are not convinced. Already, because of the US pressing the EU on Greenland, investors expect geopolitical tensions to continue simmering. Fear of a full-blown trade war is what explains the pivoting to physical gold and the suffering of cryptos and tech stocks, not only in Europe but also in the US.

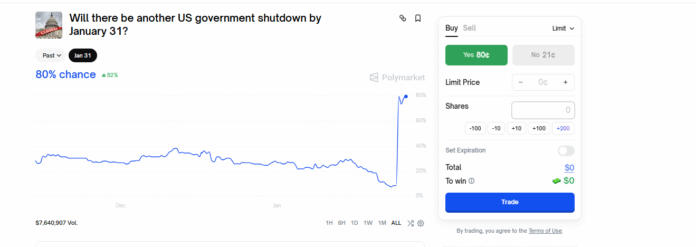

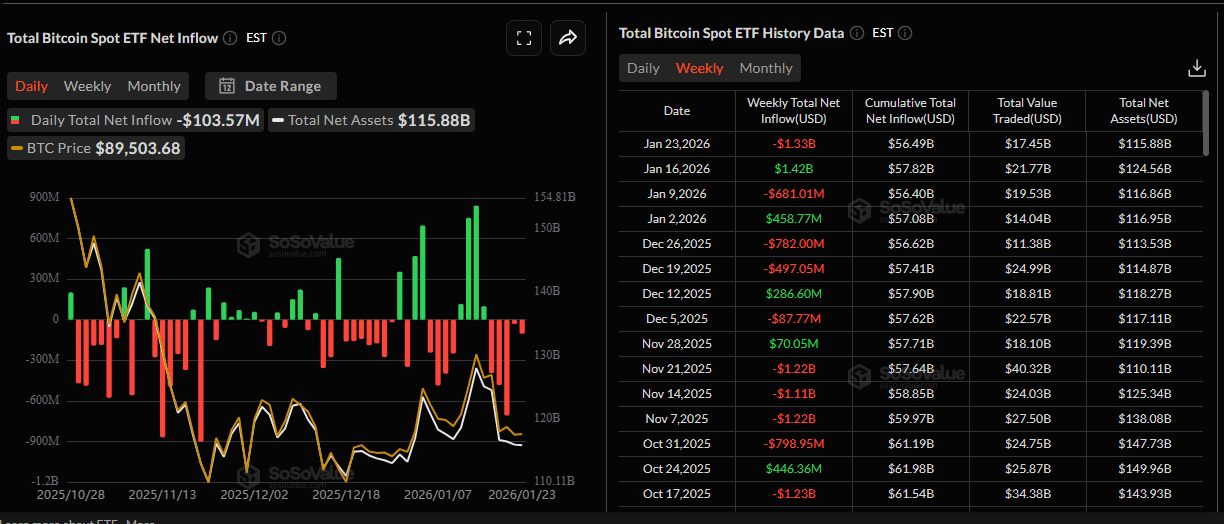

Trump and Greenland aside, there are renewed fears that another US government shutdown is around the corner. Negotiations in Congress have hit a wall. As a result, over the weekend, punters on Polymarket are upping the odds of a shutdown.

At the moment, it stands at +80%, up from below +30% only a few days ago. This uncertainty on whether operations will stall in the US is inevitably creating fears of “dollar-debasement.” Although this might be good for Bitcoin in the long term, investors tend to react by first selling everything, negatively impacting risk assets.

(Source: Polymarket)

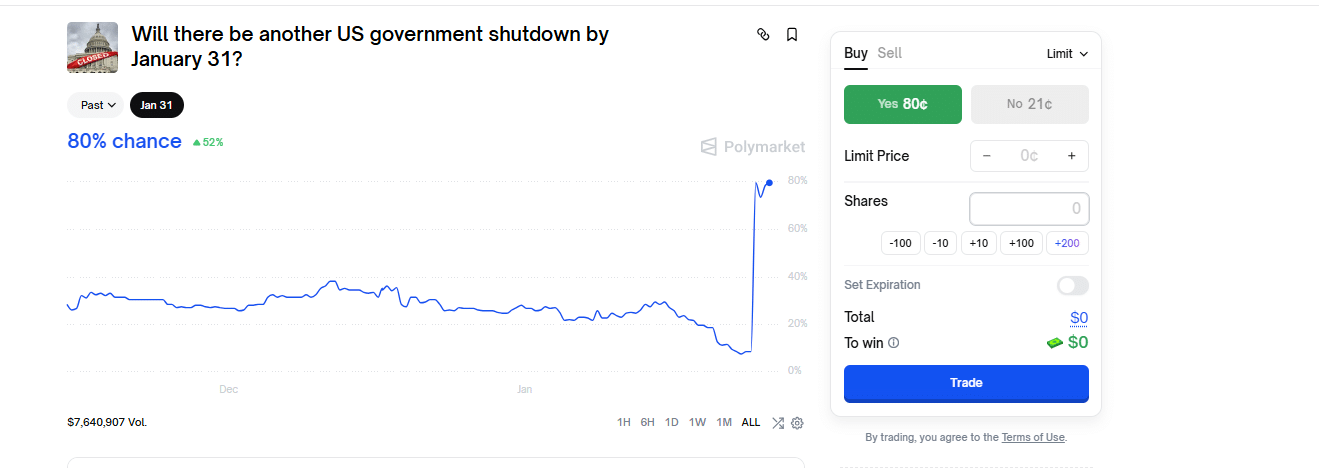

This sell-off shows in spot Bitcoin and Ethereum ETF outflows. Over $1.3Bn of spot Bitcoin ETFs were redeemed last week, coinciding with a Bitcoin USD price drop to $86,000 over the weekend.

(Source: SosoValue)

DISCOVER: 9+ Best Memecoin to Buy in 2026

Will Gold Extend Gains?

Unless there are catalysts that will drive Bitcoin USD prices above $95,000, sellers will likely press on. Meanwhile, gold, which is a go-to safe-haven asset for central banks, is breaking out. During the Asian session, prices spiked above the $5,100 level, printing fresh all-time highs.

Often, gold buying accelerates during periods of policy stress and geopolitical noise. The EU, China, and BRICs are unhappy with the US’s bullying of Denmark. And with threats of tariffs, central banks, specifically led by China and India, have been buying gold at historic rates, diversifying away from the greenback. In this shift, central banks now hold more gold than treasuries for the first time since 1996.

For the first time since 1996, the value of gold held by central banks ($4.6 trillion) exceeds the value of the US Treasurys they hold ($3.9 trillion). $gld pic.twitter.com/QLHITeeq9F

— Special Situations

Research Newsletter (Jay) (@SpecialSitsNews) January 26, 2026

As central banks stack up, fears of another government shutdown and ballooning national debt are forcing investors away from paper assets like bonds. Instead, they prefer physical gold, an asset that’s globally accepted as a store of value.

If this trend continues, and the geopolitical landscape remains fractious as it was last week, gold will likely print fresh all-time highs towards $5,200. On X, one analyst says the gold rally is “only getting started.” He expects central banks to continue buying gold in the coming months.

This gold rally has only just started

There is still about 2/3 of upside in this cycle

Gold as a % of global reserves is only 25% but rising rapidly

In the 70s and 80s it was at 60% to 70%

The US dollar of global reserves is now dropping sharply and gold is on the rise… pic.twitter.com/KjjaPGTNaa

— Rich (@moneytechpower) January 25, 2026

DISCOVER:

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis.

The post Bitcoin USD Price Slips To $86K, Gold Steals the Spotlight appeared first on 99Bitcoins.